How Nixon changed the world forever in ’71. (Destroying the gold standard)

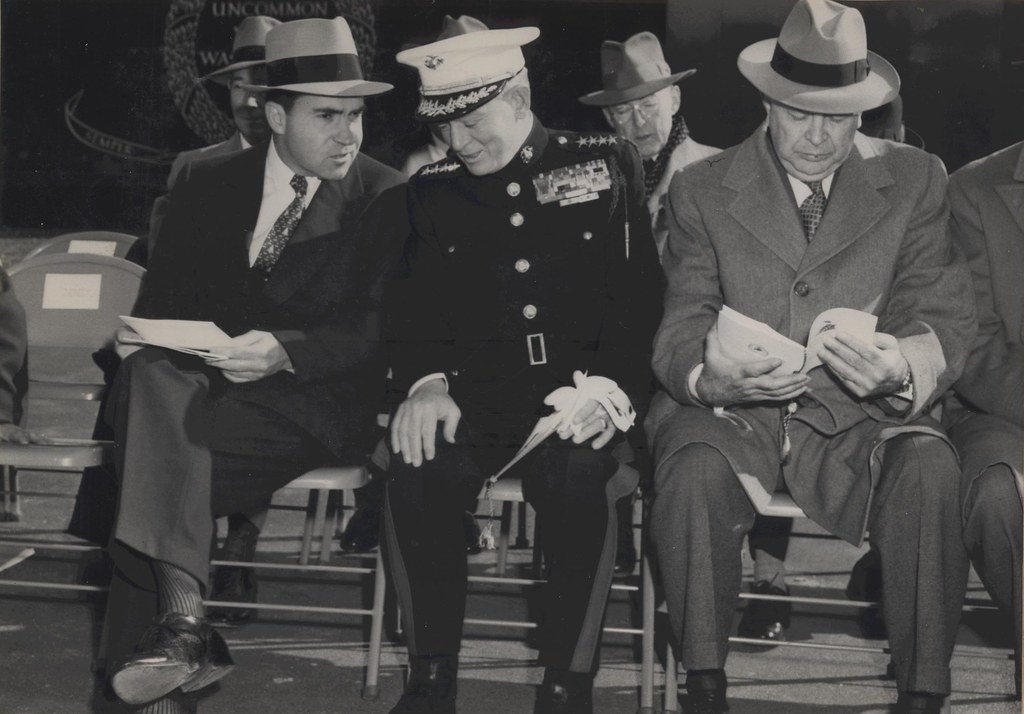

Richard Nixon and Lemuel Shepherd, 10 November 1954

Nixon’s decision to abandon gold standard reshaped finance, let’s see how.

President Richard Nixon’s move to sever the link between the U.S. dollar and gold, often referred to as the “Nixon Shock,” had profound implications for the economy and the global financial system. This decision effectively ended the gold standard, a system where the U.S. dollar was backed by a fixed amount of gold, and other currencies were pegged to the dollar at set exchange rates.

One immediate consequence of this shift was the abandonment of fixed exchange rates among currencies. Currencies began to float freely, their values determined by market forces of supply and demand. This newfound flexibility led to increased exchange rate volatility and fluctuations in currency values, affecting international trade and investment.

With the gold standard out of the picture, the U.S. government gained more latitude in implementing monetary policies. The Federal Reserve could now pursue expansionary policies, which involved increasing the money supply to stimulate economic growth or combat inflation. However, this freedom also contributed to inflationary pressures during the 1970s.

Furthermore, the move impacted international trade dynamics. Some countries found their exports becoming more competitive as their currencies depreciated relative to the U.S. dollar. Meanwhile, the United States began running trade deficits as imports became cheaper. These trade imbalances had significant economic and political implications, including trade disputes and protectionist measures.

Around the same time as the Nixon Shock, the world faced an energy crisis with soaring oil prices due to geopolitical tensions in the Middle East. The devaluation of the U.S. dollar further contributed to higher oil prices, exacerbating inflationary pressures and economic challenges.

In the broader context, the Nixon Shock marked a departure from the post-World War II economic order. It paved the way for a new international monetary system characterized by floating exchange rates and fiat currencies, a system that has endured for decades. This transformation had long-term implications for the global financial architecture, reshaping how currencies are managed and traded on a global scale.

The economist most closely associated with the decision to end the gold standard and implement the policies of the Nixon Shock was Milton Friedman. Friedman was a prominent American economist and a leading proponent of the monetarist school of thought.

Friedman’s theory, known as monetarism, emphasized the importance of controlling the money supply to achieve stable economic growth and low inflation. He argued that excessive increases in the money supply were the primary cause of inflation, and therefore, central banks should focus on maintaining a stable and predictable rate of money supply growth.

In the context of the Nixon Shock, Milton Friedman advocated for the abandonment of the gold standard because it limited the flexibility of monetary policy. Under the gold standard, the money supply was tied to the amount of gold held by the central bank, which meant that monetary authorities had to adjust their gold reserves to control the money supply. Friedman believed that a system of flexible exchange rates and the ability to control the money supply through open market operations would be more effective in achieving stable economic conditions.

Anyways, from that moment, market was and is the king, with no respect for human life, just for profit.

That is a list of some consequences that still are hitting our world :

Exchange Rate Volatility: The system of floating exchange rates introduced greater currency volatility. While this flexibility can be beneficial for some aspects of international trade, it also makes currency markets more unpredictable, leading to exchange rate fluctuations that can disrupt trade and investment.

Currency Speculation: The floating exchange rate system has allowed for increased currency speculation, where traders and investors bet on short-term currency movements. This speculative activity can amplify exchange rate movements and lead to financial instability.

Trade Imbalances: The flexibility of exchange rates has contributed to trade imbalances, as currencies can become overvalued or undervalued. Persistent trade imbalances can lead to tensions between countries and protectionist measures.

Exchange Rate Crises: Some countries have experienced currency crises, often triggered by excessive speculation or sudden shifts in market sentiment. These crises can have severe economic and social consequences, including recessions and financial instability.

Inflation and Monetary Policy Challenges: While flexible exchange rates offer more autonomy in monetary policy, they also pose challenges for central banks. Managing inflation and exchange rates simultaneously can be complex, and mistakes in policy can lead to economic instability.

Exchange Rate Misalignment: Floating exchange rates can sometimes lead to currency values that don’t accurately reflect economic fundamentals. This misalignment can hinder trade and investment decisions.

International Coordination: The absence of a fixed exchange rate system has made international economic coordination more challenging. Countries may have divergent monetary policies that can lead to conflicts in global economic governance.

Currency Wars: The flexibility of exchange rates has at times led to accusations of competitive devaluations or “currency wars,” where countries seek to devalue their currencies to gain a competitive advantage in trade. Such actions can escalate trade tensions.